How to keep your Business Safe With General Liability Insurance? How important does General Liability Insurance? There are many catastrophes that might severely hurt your bottom line. Your employee might, for instance, spill a can of white paint on some items. Or a client could suffer an injury after stumbling over a rug at your establishment. Or you can face legal action for reputational harm resulting from something you or a worker said.

In order to keep Your Business Safe With General Liability Insurance protects it from issues of this nature (and more). It's a crucial kind of insurance for proprietors of small businesses. Let's find out about Hartford- one of the best General Liability Insurance with nutriwhiteplus.blogspot.com now.

What is the General Liability Insurance?

What exactly is general liability coverage? This is a common query among business owners. They also want to know if they require the general liability definition, not just what it is. Liability insurance, in actuality, is a crucial component of an insurance strategy. General liability insurance (GLI) can aid with allegations that your company damaged property or caused bodily harm. This insurance is also known as general liability commercial insurance (CGL).

GLI is available as a stand-alone policy or as a Business Owner's Policy package with other important coverages (BOP). We're here to explain the insurance coverages your company could require. We can help you with anything from knowing the definition of general liability insurance to obtaining a general liability insurance quote.

The Hartford: Keep Your Business Safe With General Liability Insurance

How does Hartford- General Liability Insurance keep your business safe?

Business Safe With General Liability Insurance is provided by commercial general liability (CGL) insurance in the event that you are sued for an accident that happened at your place of business, for damaging a visitor's property, or for causing advertising harm, such as defamation, copyright infringement, or libel.

The reasonable costs associated with your legal defense will be covered by your general liability insurance. This covers legal, judicial, and expert witness fees. Additionally, it protects you against any financial losses you sustain while taking part in your defense. General liability insurance also pays for the plaintiff's medical costs and any verdicts or settlements associated with your lawsuit.

Settlements and court rulings in cases of severe property damage or injuries can quickly put a small business out of business. General liability insurance is one of the most widely used insurance products as a result. Not included under general liability insurance are:

losses or harms you bring about via carelessness

Your property, whether private or commercial

Your individual automobiles or watercraft

Unauthorized access to your private information Professional services offered to a customer

Injuries or illnesses affecting your own staff

Any harm or damage you purposely cause

What Is Covered by Hartford General Liability Insurance?

Costly lawsuits that could develop during routine business activities are covered by general liability insurance. Without coverage, you would be required to pay these general liability insurance premiums out of pocket, which is difficult for many businesses to do.

A general liability insurance coverage can assist in paying claims brought against your company for:

1. Third-party bodily injury:

A consumer can file a lawsuit against your company if they are wounded after tripping and falling in your shop. The bodily injury liability coverage in your insurance policy will aid in covering their medical expenses.

2. Property damage to third parties:

If you or your workers conduct business at a client's home, there is a chance that you or they will cause damage. If your company damages someone else's property, property damage liability coverage can assist in paying for the necessary repairs or replacements.

3. Damage to reputation:

Because of something you or one of your workers said, your company could be sued for libel or slander. If this occurs, general liability insurance may be able to help defray some of the cost of defending your company in court.

4. Advertising injury:

A lawsuit for copyright infringement against your company may result in advertising harm. For instance, if you utilize a photographer's image without their consent in your advertisements, they may sue you.

Be aware that not all claims are covered by general liability insurance. Examples of claims that hurt your business include:

Employees who experience diseases or injuries due to their jobs may be covered by workers' compensation insurance. Their medical bills and ongoing care expenses may be covered in part by this insurance.

Damage to the property used for your own company, which commercial property insurance can aid with.

Errors in the professional services provided by your business, which professional liability insurance can help to cover.

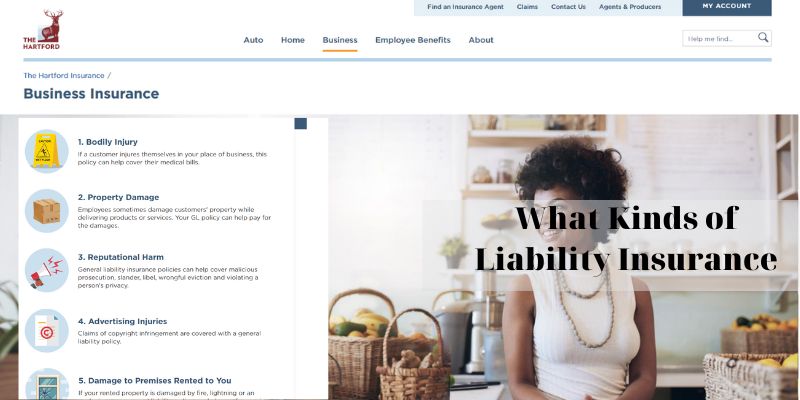

What Kinds of Liability Insurance Are There?

In addition to some of your current liability policies, commercial umbrella insurance offers additional limits to assist you to cover pricey claims.

If a current or former employee sues you for harassment, discrimination, or wrongful termination at work, employment practices liability insurance may assist pay your defense expenses as well as settlements or verdicts.

Directors and executives of your company are protected from expensive claims with the aid of management liability insurance.

If you use a vehicle for work, having commercial auto insurance can help to keep you and your staff safe while driving.

The price of Hartford General Liability Insurance:

Our customers paid for general liability insurance an average of $88 a month for Business Safe With General Liability Insurance. We work hard to provide our clients with the best protection at the most reasonable cost. Hartford is aware of the requirements of its small company owners. The cost of general liability insurance varies, but we can provide you with an estimate right away so you'll know how much it will cost. Just keep in mind that because every firm is distinct, general liability insurance premiums vary for each individual. Insurance costs are determined by a variety of things.

Because the location is one of the factors an insurer can utilize, costs, for instance, differ by state. In addition, insurers may consider the following:

Type of enterprise

Revenue

Employee count Information about the policy, such as the deductibles and coverage limits

Why Is General Liability Insurance Necessary?

There are often liability issues, and they can be very expensive. In reality, liability claims are anticipated to affect 4 out of 10 small enterprises during the next 10 years. The main reason people attend the emergency room is due to slips and falls. 1 A claim of this nature typically costs $35,000 to make. The average cost of defending and settling a claim might rise to more than $75,000 if a lawsuit is filed in response to it. Your company would be forced to fund these expenses out of pocket without general liability insurance, which could drive you out of business.

Keep Your Business Safe With General Liability Insurance may also be required before you may collaborate with other companies. A certificate of liability insurance, often known as evidence of insurance, may be requested by some businesses.